Volume 48: Are Nonprofits Duty Bound to Invest Responsibly?

About ImpactPHL Perspectives:

ImpactPHL Perspectives is a multi-part content series that explores the many facets of the impact economy in Greater Philadelphia from the perspectives of its doers, movers, shakers, and agents of change. Each volume is written directly by a leader in this space, to discuss best practices and share lessons learned while challenging our assumptions about financial and impact returns. For more thought leadership like this, check out the full catalog of ImpactPHL Perspectives.

Christopher Clarkson, Director at Bernstein Private Wealth Management

Faced with an intractable pandemic, an unprecedented recession, and heightened awareness of racial injustice, nonprofits have responded valiantly, deploying resources to help vulnerable communities meet their most basic needs. Some local food banks have seen a 400% increase in demand while organizations addressing racial equity have been leading ad boycotts, registering voters, and advocating for reforms.

Even as an estimated third of nonprofits face potential extinction, many wish they could do more, and point to lack of funding as an obstacle. (1) But there’s an overlooked tranche of capital that could be deployed in service to the community—nonprofits’ investment pools. If positioned effectively, these assets could work “behind the scenes” to further promote equality and societal well-being.

Investing with Purpose

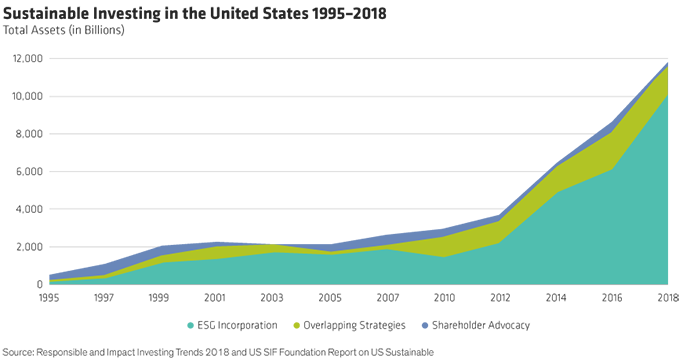

Responsible investing strategies have clearly come into their own this year. According to Morningstar, net inflows to sustainable funds in the U.S. reached $20.9 billion in the first half of 2020, compared with $21.4 billion for all of 2019. Recent momentum comes against the backdrop of steady gains in popularity over the last two decades. Assets in strategies that consider environmental, social, and governance issues (ESG), including shareholder advocacy, have increased by more than 14% per year since 1995 (Display).

Past performance is not indicative of future results.

Source: Bain - Global Private Equity Report 2019

Yet despite growing acceptance, some organizations still struggle to understand their obligation to promote responsibility in their investments.

Your Fiduciary Duty

Theoretically, most organizations would love to do good while earning a profit. And while donors often encourage organizations to adopt mission-aligned investments, board members and investment committees must adhere to their duties as fiduciaries.

A decade ago, fiduciaries wondered, “Will considering ESG investments violate my fiduciary duty?” Today, that question has been turned on its head. Decision-makers now ask, “Will I breach my fiduciary duty by not investing responsibly?” According to a recent survey by Cerulli Associates, 87% of asset owners cited “fiduciary duty” as the biggest factor driving their decision to use ESG criteria. But is pursuing responsible investing in line with current legislation?

Duties of Loyalty, Care… and Performance

A recently proposed rule by the U.S. Department of Labor has taken a stricter position on ESG investing by retirement plan fiduciaries. If finalized, the rule would prohibit plan fiduciaries from placing social goals ahead of financial goals when making decisions in the best interest of plan participants. However, nonprofit fiduciaries—when overseeing the reserves and endowments of their organization—are instead governed by the Uniform Prudent Management of Institutional Funds Act (UPMIFA).

“Investing with integrity also means considering performance. Fiduciaries have the flexibility to include responsible investments as part of an overall investment strategy if it doesn’t increase risk and sacrifice returns.”

That means nonprofit fiduciaries are bound to consider the charitable purposes of the institution and the fund, and are subject to three primary duties: loyalty, obedience, and care (prudence). They need to put the interests of the nonprofit before their own and cannot promote their personal values. They are also required to invest in good faith and with the care an ordinarily prudent person in a similar position and circumstance would exercise. This includes considering the intent of a donor’s charitable gift, the nonprofit’s purpose, general economic conditions, the effects of inflation, and the role the investment plays within the portfolio. (2)

Investing with integrity also means considering performance. Fiduciaries have the flexibility to include responsible investments as part of an overall investment strategy if it doesn’t increase risk and sacrifice returns. In the past, many believed that investing with a purpose meant accepting lower returns. But evidence that responsible strategies perform as well as or better than non-ESG strategies is mounting.

Investing with Purpose Bolsters Fiduciary Oversight

Many experts now believe failure to integrate ESG factors in investment decision-making represents a breach of duty. The reasons are simple: Policy and regulatory frameworks are changing to require ESG incorporation because the issues are financially material and consideration of them is an investment norm. (3)

As one of the authors of the UPMIFA, Professor of Law Susan Gary argues, “the prudent investor standard continues to adapt to changes in financial knowledge and practice, and the standard now includes consideration of material ESG factors as part of an overall financial analysis.” There are various ways this can be done—using a single or combination of approaches from screening to impact. For instance, the US SIF Foundation identified over 100 foundations in 2018 that applied one or more ESG criteria to their $68 billion in assets. Regardless of the approach, responsible investing strategies should report on the impact of their ESG actions as well their risk and return.

Getting Started

Fiduciaries who want to align their portfolio with their mission should begin by reviewing their organization’s investment policy statement. If it doesn’t mention investment practices that are consistent with their mission, it might be time for an update. They should also consult with their advisors to determine which type of strategies make sense for their needs. As the current crisis highlights, there’s never been a better time to draw on every possible tool to help those in dire need.

Sources

(1) https://www.washingtonpost.com/local/non-profits-coronavirus-fail/2020/08/02/ef486414-d371-11ea-9038-af089b63ac21_story.html

(2) Uniform Prudent Management of Institutional Funds Act, Section 3, 2006.

(3) United Nations Environment Programme Finance Initiative.

The views expressed herein do not constitute research, investment advice, or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams, and are subject to revision over time.

Christopher J. Clarkson is a Director at Bernstein Private Wealth Management. He has expertise in a variety of complex investment planning issues, including diversification planning for holders of concentrated stock and option portfolios, retirement planning, multigenerational wealth transfer, philanthropy, advanced asset allocation and planning for the sale of a business. Chris joined the firm in 1995 and became a member of the Wealth Strategies Group in 1998. He earned a BA with high honors in business/economics from the University of California, Santa Barbara, and is a Chartered Financial Analyst charterholder.