Volume 86: Investing in Arts and Culture for Generations of Healthy Communities

About ImpactPHL Perspectives:

ImpactPHL Perspectives is a multi-part content series that explores the many facets of the impact economy in Greater Philadelphia from the perspectives of its doers, movers, shakers, and agents of change. Each volume is written directly by a leader in this space to discuss best practices and share lessons learned while challenging our assumptions about financial and impact returns. For more thought leadership like this, check out the full catalog of ImpactPHL Perspectives.

Penelope Douglas, Founder & CEO, CultureBanq

When I look at communities across the United States, I see overlapping vulnerabilities in climate, health, and economic mobility. At the same time, I paid close attention to a slide in a recent presentation by David Erickson of the Federal Reserve Bank of New York, which tallied an approximate $2.4 trillion expended annually by federal sources in community investment. This doesn’t count private investment dollars.

Why haven’t significant investments moved the needle? One reason, for certain, is that social investment innovators and problem-solvers are most often working in and funded in silos, separating research from learning through practical application, and large-scale dollars from the knowledge of hyper-local experience. Systemic barriers for low-income communities persist.

Yet, there is an enormous underinvestment in culture. You might define culture in many ways, but I primarily mean the inherent, meaningful dynamics of a community - connections and relationships, rituals and traditions, languages, the things that bring communities cohesion and, therefore, well-being (about which we have increasing data for example how culture and art improves youth mental health. Culture is expressed through the assets that communities value but are often not seen, understood, or valued by the traditional investment equation.

“Why haven’t significant investments moved the needle? One reason, for certain, is that social investment innovators and problem-solvers are most often working in and funded in silos, separating research from learning through practical application, and large-scale dollars from the knowledge of hyper-local experience. Systemic barriers for low-income communities persist.”

Making a “Missing Market” in Community Investment

The concept of investing first in culture, and in artists themselves, as central actors illuminating and articulating the culture of our neighborhoods and communities, is one which I and many believe may be a critical piece in making a “missing market.” The Federal Reserve Bank of New York explains making a missing market as working within existing ecosystems and/or creating new ones to accomplish the following things, all in the service of creating an economy that works for all:

connect new sources of capital to community needs

scale existing sources of capital to meet a community need; and/or

connect previously unlinked buyers and sellers so that they can work together to finance solutions that create value and wealth

These missing markets, if we can articulate and model them, will result in more productive, regenerative forms and uses of capital and non-financial assets returning substantial, long-term impacts and outcomes in communities and places, along with measurable financial benefits.

Over the years, through my work within and at the intersection of the arts, culture, and community investment sectors, I have prototyped and tested innovative artist and community-led solutions through a variety of compelling collaborations. Yet, this work needs the support of large forums that can grow these innovations and influence systems change. Fortunately, over the past two years I have been a participant with the Federal Reserve Bank of New York’s Community Development Division, opening new doors in thinking about creative methods in their strategic work of opportunity-rich communities. In 2024, Making Missing Markets became the multi-year collaboration between the Federal Reserve Bank of New York and two dozen design teams from around the country, focused on innovations ranging from broadband access to rural investment to community ownership.

Investing in Arts & Culture: An Idea, A Design Team, & Potential Paths Forward

I’m fortunate to be guiding one of these design teams: Investing in Arts and Culture for Future Generations of Healthy Communities. The goal of this work is for investors to highly value artists in every existing and new market in community investment. The individuals working toward this common goal, our design team members, have worked together since June of 2024 and are honestly awesome - a diverse, multigenerational group of both national and hyper-local arts & culture organizations, community investment, and health practitioners, as well as artists.

This group became grounded by its consensus about two compelling ideas in ‘missing markets’:

that opportunity-rich neighborhoods are also more likely to be healthy neighborhoods, and

that artists are undervalued or overlooked in community investment and impact investment, yet are critical, central actors in making a missing market.

Members of the design team drew from numerous direct experiences of leading or guiding initiatives that bring investors closer to the many ways in which cross-sectoral collaboration among public and private sectors, arts and artists, and health organizations are demonstrating what may be possible.

In considering the complexity of making a missing market, our team focused on the necessity for a marketplace shift- what might investors value differently? And how does that shift open up greater opportunities for very low-income and marginalized neighborhoods? For example, what if investors valued artists highly as key actors in building new markets for community-led climate and health solutions?

The good news is that there are already beautiful cases of place-based, cross-sectoral investment tools and structures that don’t rely on philanthropy as the sole source of financial capital. Community bonds are one such case.

Other cases include:

Artist-led, community-first development projects like East Bay Permanent Real Estate Cooperative or Boston Ujima Project

Very long-term, no, or low-interest debt, with the interest increasing as the risk declines

Capital pools, including artist-owned pools

Use of non-financial assets as components of innovative investment structures- for example, a wealth holder pledges art as risk mitigation for a group of impact investors.

However, these ideas remain elusive in terms of a transformation, i.e., changing or rearranging a missing community investment market- and they provoke key questions: who/which actors are actually on the demand side, who/which actors are on the supply side, and how can buyers and sellers access opportunities? And how do we tie the incredibly important networks in community-based health and hyper-local economies to the model?

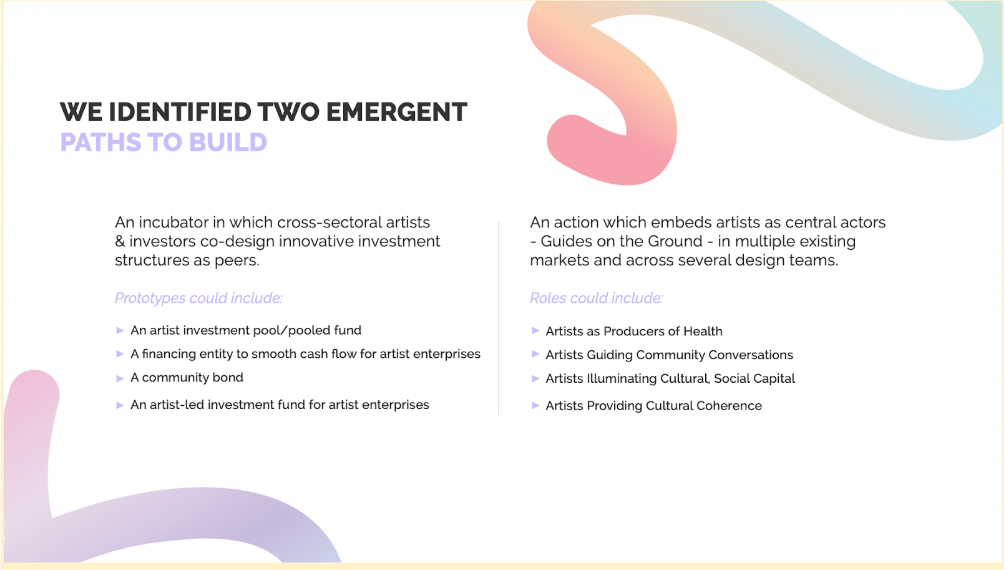

Wrestling again with these questions led our design team to advocate two paths forward for action

Can Philadelphia Be A Place to Prototype?

Philadelphia has long been committed to and known for its arts and culture sector and is uniquely poised to be a national leader in articulating, through action, the key elements of this missing market.

Building on current local momentum, energy and attention on arts and culture - from Greater Philadelphia Cultural Alliance’s cross-city collaborations and wins such as keeping the University of Arts Hamilton building in local ownership - the moment is now to dig even further. As our national public funding and philanthropic landscapes shift, we must understand how to nurture and sustain local artists and arts and culture enterprises that contribute so deeply to Philadelphia’s neighborhoods, civic, and cultural life.

“What if investors valued artists highly as key actors in building new markets for community-led climate and health solutions?”

Yet, the key will be not to follow the same narratives and approaches but to form a collaboration that embraces the real narratives of Philadelphia’s neighborhoods where culture exists and that facilitates a community and/or artist-led dialogue without predisposition about the answers to some of these provocative questions. When communities articulate their needs and wants, then we can co-design the vehicles that can bring the most responsive capital to them, facilitated by community governance and driving toward community wealth creation.

As ImpactPHL implements its strategic commitment to bring more impact capital to bear in arts and culture, how might the network test more than one impact goal together with city, community, cultural, and artist leaders for both economic opportunity and future generations of health and well-being in Philadelphia neighborhoods? What can we imagine and create together?

Penelope Douglas has spent her career at the intersections of social investment, community investment, art and culture, and the health of communities. For the past several years, she has worked with others in cooperative, collaborative, distributed leadership, and solidarity models.She works with social change movement builders and organizations across sectors including health, arts and culture, and regenerative capital. Recent and current engagements include roles as Impact Advisor to One Nation One Project, Strategic Advisor to The Lewis Prize for Music, Organization and Strategic advisor to The Guild of Future Architects. From 2020-2022 she was the Chief of Strategy for Yerba Buena Center for the Arts. Among many initiatives she guided were the Artist-Led Giving Circle and the Guaranteed Income Pilot for Artists.